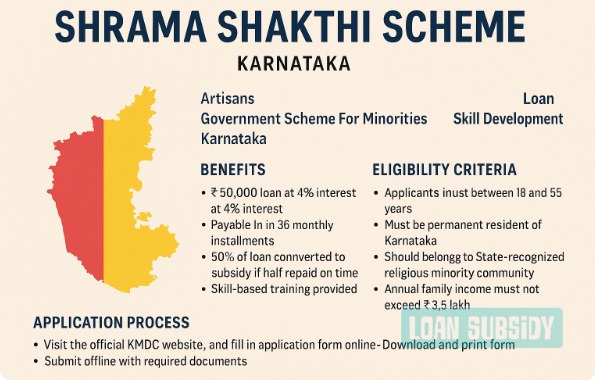

The Shrama Shakthi Scheme is a unique initiative by the Karnataka Minority Development Corporation (KMDC) aimed at empowering religious minority entrepreneurs in the state. This scheme offers financial assistance in the form of a subsidized loan along with technical and artistic training to help uplift individuals through self-employment opportunities.

Highlights of KMDC Loan Subsidy Scheme

• Loan of ₹50,000 at 4% interest

• Payable in 36 monthly installments

• 50% of the loan converted to a subsidy if half is repaid on time

• Skill-based training provided to beneficiaries

• Beneficiaries selected by a district-level Selection Panel

• Dual application process – Online + Offline

Key Benefits

• ₹50,000 loan provided at a subsidized 4% interest rate

• Loan repayment spread over 36 monthly installments

• 50% of the loan is waived off as a back-end subsidy if 50% is repaid within 36 months

• Skill development training in artistic and technical fields

• Financial upliftment of religious minority communities through entrepreneurship

Eligibility Criteria

• The age of the applicant must be between 18 and 55 years

• Must be a permanent resident of Karnataka

• Should belong to a state-recognized religious minority community

• Annual family income must not exceed ₹3.5 lakh

• Should not have received benefits under other KMDC schemes in the last 5 years (excluding Arivu Scheme)

• No family member should be employed in the State/Central Government or PSUs

• Applicant must not be a loan defaulter with KMDC

Exclusions

• Government or PSU employees and their families are not eligible

• Individuals with outstanding loans or defaults under KMDC are disqualified

How to Apply

Online Process

-

Visit the official KMDC website

-

Fill in the Shrama Shakthi Scheme application form

-

Download and print the filled form

Offline Process

-

Submit the printed form along with all necessary documents to the Selection Panel of your district

-

Upon approval, the subsidy amount will be directly credited to the beneficiary’s bank account

Necessary Documents

• Printed application form (filled online)

• Two recent passport-sized photographs

• Caste and Income Certificate

• Photocopy of the Aadhaar Card

• Business Project Report

• Copy of Bank Passbook

• Self-Declaration Form

• Surety’s Self-Declaration Form

Selection Committee Members

• Deputy Commissioner of the district – Chairman

• Chief Executive Officer of Zilla Panchayat – Vice-Chairman

• Lead Bank Manager – Member

• Regional Transport Officer – Member

• District Minority Welfare Officer – Member

• KMDC District Manager – Member Secretary

Frequently Asked Questions (FAQs)

Q: Who is eligible to apply under the Shrama Shakthi Scheme?

A: Applicants between 18 and 55 years of age from religious minority communities in Karnataka with a family income below ₹3.5 lakh per annum.

Q: What is the loan amount offered under this scheme?

A: A loan of ₹50,000 is provided with a 4% interest rate.

Q: Is any training offered under this scheme?

A: Yes, artistic and technical skill development training is part of the scheme.

Q: What happens if I repay 50% of the loan within 36 months?

A: The remaining 50% of the loan will be waived off as a back-end subsidy.

Q: Can government employees apply for this scheme?

A: No, applicants or their family members working in government or public sector units are not eligible.

Q: What documents are needed to apply?

A: You need an Aadhaar card, income & caste certificate, passport photos, business project report, bank passbook, and two declaration forms.

Q: Where can I get the declaration forms and caste certificate?

A: These are available at Taluk Offices, District Minority Welfare Office, or can be downloaded from the KMDC portal.

References Links

• KMDC Official Website

• Scheme Report – Shrama Shakthi Scheme PDF

• Government Notifications & Scheme Guidelines