To empower Scheduled Caste (SC) and Scheduled Tribe (ST) entrepreneurs in the manufacturing and services sector, the Ministry of Micro, Small & Medium Enterprises (MSME) has launched the Special Credit Linked Capital Subsidy Scheme (SCLCSS). It is a sub-scheme under the National SC/ST Hub (NSSH) initiative.

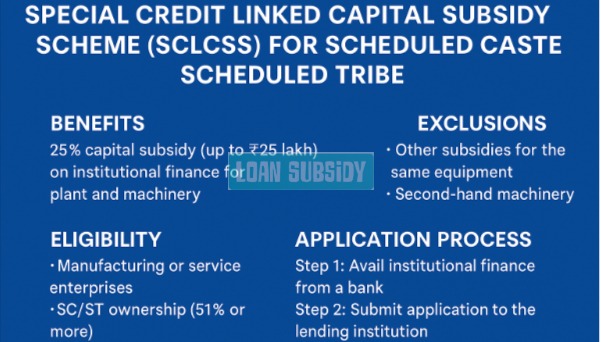

The scheme provides 25% capital subsidy (up to ₹25 lakh) to eligible SC/ST-owned MSMEs for the purchase of plant and machinery/equipment through institutional financing. The goal is to enhance the capacity of existing MSEs and promote the creation of new enterprises within SC/ST communities.

Highlights of SCLCSS Scheme

• Scheme Name: Special Credit Linked Capital Subsidy Scheme (SCLCSS)

• Launched By: Ministry of MSME, Government of India

• Under: National SC/ST Hub (NSSH)

• Type of Support: 25% capital subsidy (up to ₹25,00,000)

• Target Group: SC/ST-owned manufacturing and service enterprises

• Mode of Application: Offline via Prime Lending Institution (Bank)

Key Benefits

• Capital Subsidy: 25% subsidy on the institutional loan amount

• Subsidy Cap: Maximum subsidy of ₹25,00,000

• No Sector Restriction: Applicable across all industries (manufacturing or services)

• Supports New and Existing MSEs: Helps in modernization and scale-up

Eligibility Criteria

• The business must be a proprietorship, partnership, cooperative, LLP, or Pvt. Ltd./Public Ltd. company owned by SC/ST entrepreneurs

• Must have a valid Udyam Registration

• Minimum 51% shareholding by SC/ST entrepreneur(s) in the firm

• Applies to:

-

Existing SC/ST MSEs

-

SC/ST units upgraded from small to medium scale (within 3 years)

-

New units growing to medium scale due to loan eligibility

Exclusions

• No dual subsidy: Applicants cannot claim a subsidy under SCLCSS and another government scheme for the same equipment

• Used/fabricated machinery is not allowed

• Units already availing similar benefits from other Central/State Govt schemes for the same plant/machinery are not eligible

How to Apply – Offline Process

• Step 1: Avail institutional finance/loan from a recognized bank (Prime Lending Institution – PLI)

• Step 2: Submit the completed application along with the required documents to your PLI

• Step 3: The PLI will forward the application to the Nodal Bank/Agency (like SIDBI or NABARD)

• Step 4: The nodal agency will process the application and release the subsidy through the MIS portal under the Ministry of MSME

Necessary Documents for Application

• Self-attested copy of Udyam Registration

• Self-attested copy of PAN Card (of proprietor or company)

• Caste Certificate of all partners/directors/proprietors

• Copy of Partnership Deed or MOA/AOA (for LLP/Pvt Ltd)

• Proof of ownership/shareholding structure (SC/ST shareholding > 51%)

• Payment receipts and GST invoices of plant/machinery

• Attested NABL/BIS testing report, if applicable

• Cancelled cheque of the business current account

• Proof of reimbursement if already availed under NSIC/NSSHO in the same financial year

Frequently Asked Questions (FAQs)

Q: Who can apply under the SCLCSS scheme?

A: SC/ST entrepreneurs who own manufacturing or service-based MSMEs with valid Udyam Registration and over 51% SC/ST ownership.

Q: What is the maximum subsidy limit under this scheme?

A: The maximum subsidy offered is ₹25,00,000 on the institutional loan taken for plant and machinery.

Q: Can I apply if I already claimed a subsidy for machinery under another scheme?

A: No, applicants availing similar subsidies under other Central/State schemes for the same machinery are ineligible.

Q: Is the application process online or offline?

A: The application process is offline, and must be submitted through the applicant’s Prime Lending Institution (PLI).

Q: Are second-hand or used machines eligible for subsidy?

A: No. Only new, certified equipment and machinery are eligible under the scheme.

Q: Who are the nodal agencies for this scheme?

A: SIDBI and NABARD are the nodal agencies responsible for disbursing the subsidy for eligible lending institutions.

References & Important Links

• Ministry of MSME – Government of India

• Scheme Guidelines & Circulars

• NSIC & National SC/ST Hub documentation