The Government of Assam, through the Finance Department, has launched the Aponar Apon Ghar Scheme to make homeownership more affordable for first-time buyers. The scheme supports the vision of “Housing for All” by providing subsidized home loans to permanent residents of Assam purchasing their first house. Eligible applicants can avail of a home loan subsidy of up to ₹2,50,000 for loans up to ₹40 lakh from authorized banks.

Key Highlights of Assam Housing Loan

• Scheme Name: Aponar Apon Ghar – Home Loan Subsidy Scheme

• Launched By: Finance Department, Government of Assam

• Target Group: First-time homebuyers who are permanent residents of Assam

• Subsidy Amount: ₹1,00,000 to ₹2,50,000

• Loan Amount Range: ₹5,00,000 to ₹40,00,000

• Participating Banks: Scheduled Commercial Banks, Regional Rural Banks, Assam Cooperative Apex Bank

• Mode of Application: Online

• Scheme Valid From: Loans sanctioned on or after 1st April 2019

Benefits of the Scheme

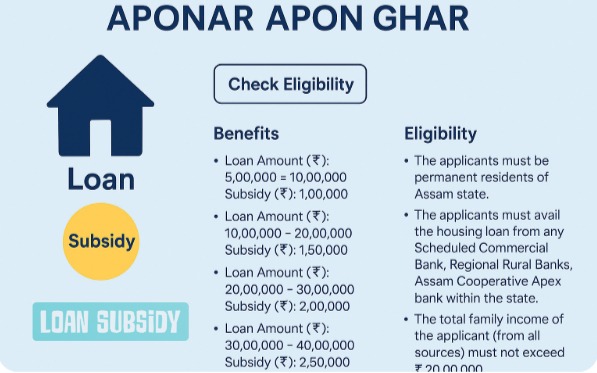

The scheme provides a graded subsidy based on the loan amount:

• Loan ₹5,00,000 – ₹10,00,000: Subsidy of ₹1,00,000

• Loan ₹10,00,000 – ₹20,00,000: Subsidy of ₹1,50,000

• Loan ₹20,00,000 – ₹30,00,000: Subsidy of ₹2,00,000

• Loan ₹30,00,000 – ₹40,00,000: Subsidy of ₹2,50,000

Eligibility Criteria

To apply for the scheme, applicants must meet the following requirements:

• Must be a permanent resident of Assam

• Must be purchasing their first house (composite family ownership)

• Must avail a housing loan from an eligible bank within Assam

• The loan amount must be more than ₹5,00,000 and sanctioned on or after 01/04/2019

• Total family income should not exceed ₹20,00,000 per year

• The loan account must not be under NPA (Non-Performing Asset)

Exclusions

• Applicants who have already received benefits under the Apun Ghar Scheme are not eligible

How to Apply – Online Procedure

• Step 1: Visit the official Assam Finance Department Portal

• Step 2: Click on “Aponar Apon Ghar (Home Loan Subsidy Scheme)” under the loan subsidy section

• Step 3: Fill in the Applicant’s Personal & Loan Details including Name, PAN, Bank IFSC, Loan Amount, Property Address, etc.

• Step 4: Upload required documents – Address proof, Land proof, PAN card

• Step 5: Agree to the declaration and click “Save” to submit your application

Check Application Status

• Step 1: Go to the official website

• Step 2: Scroll down to “Application Tracking” and click on “Track”

• Step 3: Enter your Mobile Number and Loan Account/Application Number, then click “Submit”

Necessary Documents for Application

• Residence Proof of Assam

• Identity Proof (Aadhaar, PAN, Voter ID)

• Income Certificate (for total family income)

• Bank Account Details

• Recent Passport-size Photograph

• Salary Slips (latest)

• Statement of Salary Account for the last 6 months

• No Dues Certificate (if salary credited outside SBI)

• Employment Proof (minimum 5 years in service)

• Statement of Personal Assets and Liabilities

• Land Ownership Documents (Registered land/Property papers)

Frequently Asked Questions (FAQs)

Q: Who can apply for the Aponar Apon Ghar scheme?

A: Permanent residents of Assam purchasing their first house with a sanctioned housing loan from an eligible bank can apply.

Q: What is the maximum subsidy amount under this scheme?

A: The maximum subsidy offered is ₹2,50,000 for home loans between ₹30,00,000 and ₹40,00,000.

Q: Can I apply if I have already availed benefits under the Apun Ghar scheme?

A: No, beneficiaries of the previous Apun Ghar scheme are not eligible for this scheme.

Q: Is there an offline application method available?

A: No. Currently, the application process is only online via the official Assam Finance portal.

Q: What happens if my loan account becomes NPA later?

A: Loan accounts classified as NPA at the time of application are not eligible. Post-approval changes may lead to a subsidy cancellation.

Q: Are self-employed individuals eligible?

A: Yes, as long as they meet the income and property ownership conditions and have a valid sanctioned housing loan.

References & Useful Links

• Official Assam Finance Department Website

• Scheme Guidelines and Circulars issued by the Government of Assam

• Description as available on the Assam State Portal